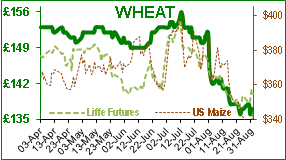

Last Friday November wheat futures closed at £139.60 and following the Bank holiday we had two quiet days. On Thursday the AHDB (see graph) confirmed DEFRA’s survey of this years old crop ending stocks which were almost 50% lower than the previous year. This came as no surprise to the grain trade, who were scrabbling about trying to find wheat to fulfil sales to feed compounders. One compounder was phoned by a grain trader on Friday the 28th July to be told that they would receive no wheat that day (over 100tons), despite having bought it four months earlier. It was only the fact that the wheat harvest was ready so early this year, that ‘saved’ the grain trade from embarrassment, and feed compounders from running out of wheat. If it had not been for the massive wheat imports in the latter months of the harvest year, the UK could well have run out of wheat in June! However the news did come as a surprise to some of the European analysts who had assumed ‘normal’ carry-out figures; and therefore with a 3% lower GB planted area this year (2016-2017) at 1.76mha indicating a 14.4mt crop was part of the reason why November wheat futures jumped £2/t to £140.75/t on Thursday.

In fact all our commodities jumped up due to a number of news items. Canada announced it will produce 25.5mt wheat which is 20% below last year’s production (31.7mt); this was widely expected, but there was also some early frost in the growing Australia wheat crop which made everyone shiver. So although the world is currently drowning in wheat, it only takes a few major wheat-exporting countries to lose 20% for supplies to tighten quickly. Russia has had a bumper harvest this year, but analysts believe that the poor Russian infrastructure will cap its export capacity. Egypt announced that it has strategic wheat reserves totalling 3.6mt which they say would cover their demand for almost 5 months. The fact is that Egypt is the world’s biggest wheat importer at about 1mt per month, so we would suggest that having three months cover is only prudent. Egypt has a problem with finding cash to pay for its wheat purchases, but remembers the food shortage/inflation element which some say prompted the 2010 Arab Spring, and so wants the best quality (no ergot), and has generally irritated its suppliers. Consequently Egypt has allowed its moisture specification to rise to 13.5% for nine months to attract more offers / suppliers.

China has been buying US soya for nearby positions (Sep & Oct) probably because South America is a reluctant seller because prices are so low. In Brazil, the grain silos are mainly full of soya, so the newly-harvested maize is either sitting on the ground, or stored in silo bags. There are concerns about where to store their winter wheat and the next soya crop in late December and early January, so it does not look as if they are in a hurry to sell anything. In Argentina things are much the same, except for some flooding (again) which is disrupting logistics, and its export barrier of taxes. Macri reduced the wheat and maize tax to zero when he came into power, but only reduced the soya export tax from 35% to 30%. He promised to reduce the soya tax by 0.5% per month from January 2018, so we may see some shift of sentiment in the New Year. The largest soya producing state in Brazil, Rio Grande do Sul, expects to increase its planting area by 3% to 5.7mha in 2017-2018, but are expecting lower yields at 2.9t/ha compared to this year’s record 3.4t/ha (so 16.8mt rather than last year’s 18.6mt). GM soya is about £280/t ex port.

At about the same period that the Saxons were invading England, the Japanese were building key-hole shaped burial mounds called kofun which date from the 3rd to 7th century AD. There are over 160,000 kofun scattered throughout Japan which vary in size from a few metres to over 400m long. The Daisen Kofun (pictured) is in Sakai, Osaka, probably the largest grave in the world by area, probably built for Emperor Nintoku, the 16th emperor of Japan who reigned from 313-399AD. To the frustration of archaeologists, they are forbidden access to the most imposing 900 kofun built for the Imperial family, which could unlock treasures as well as the mystery of the origins of the Japanese people.